Weekend Recap: Fed cuts rates amidst corona panic

This week we kick off with the news on everyone’s minds: coronavirus. If you’re in your self-quarantine bunker, we’ve got some interesting updates on Akoin, upcoming virtual crypto events and the Fed’s latest cut. We can guarantee zero boredom for at least 5 to 10 minutes.

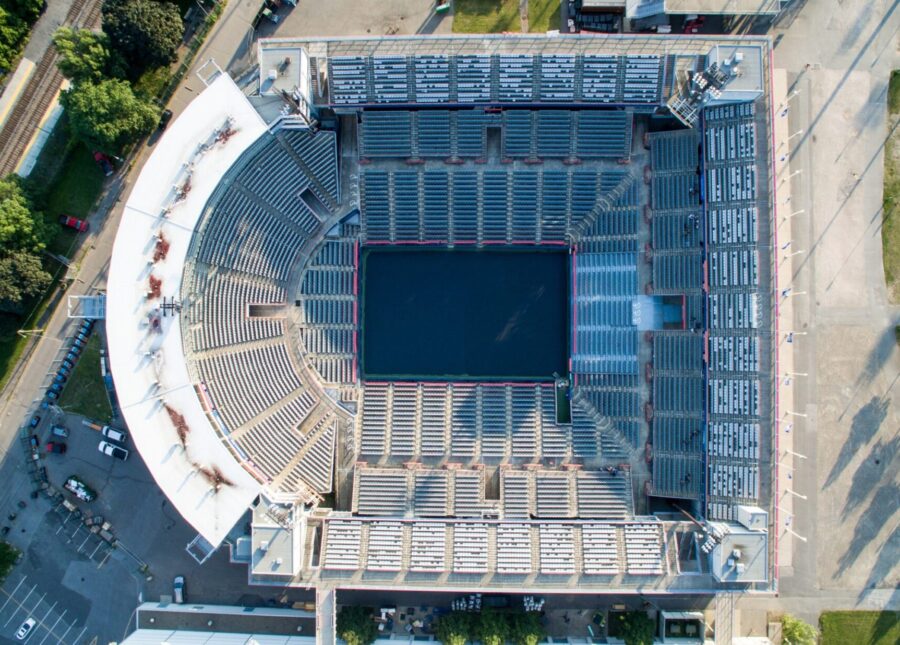

Coronavirus: NYC blockchain week cancelled

All major New York Blockchain Week events set to take place in May have been cancelled. Coindesk is moving its Consensus event – which has seen upward of 8,500 attendees in the past – to online only. Ethereum production studio ConsenSys is doing the same with its Ethereal Summit. And finally, The Block is postponing its The Block Summit.

New York Gov. Andrew Cuomo announced last week that the state would ban all gatherings of more than 500 people due to concerns over the spread of the coronavirus. He also iterated that any event expecting fewer than 500 attendees would have to reduce capacity by 50%.

Coindesk CEO Kevin Worth and Chief Content Officer Michael Casey posted a joint announcement on the company’s website regarding their upcoming event: “Consensus 2020 will now be a completely virtual experience, where attendees from all over the world can participate online at no charge.” The announcement promised a “TV-like experience” that people can enjoy from the safety of their own homes.

The event is widely considered one of the most significant in the crypto space. According to a report last year, roughly 85% of Coindesk’s $25 million total revenue for 2018 came from events alone. Regardless, Worth added “zero staff layoffs” are to be expected as a result of the cancellation.

The events industry, along with countless others, faces a massive challenge ahead. Now more than ever, decentralised event experiences are going to have to become the new norm if event organisers and companies wish to remain relevant and retain profitability.

Fed cuts rates to near zero

The Federal Reserve announced yesterday an emergency rate cut in preparation for the growing economic threat of the coronavirus pandemic. The latest cut, which is in effect as of this morning, brings the interest rate down by 125 bps to target a range of 0% to 0.25%.

According to the Fed’s statement: “The Federal Reserve is carefully monitoring credit markets and is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.” They added, “Over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion.”

Akon shares whitepaper for upcoming cryptocurrency

Rapper and entrepreneur, Akon, has shared the whitepaper for his upcoming “Akoin” cryptocurrency project.

The document outlines Akoin as a cryptocurrency “designed for entrepreneurs in the rising economies of Africa and beyond.” The project’s mission is reportedly to “unlock the potential of the world’s largest growing workforce.”

The whitepaper describes Akoins as utility tokens that power “atomic swaps” between cryptocurrencies, fiat currencies, and mobile phone credits on the Akoin network.

In his statement, it’s clear to see his awareness of the problems many African countries have been facing for decades as a result of archaic financial systems and policies: “We have so many currencies in Africa – a lot of them are unstable, and most of them are untrusted. It got to the point where the day-to-day African people don’t even use the currencies anymore, they’re just using their cell phone minutes and credits as a way of trading for basic goods like produce, fish, fruits and things on the market.”

He continued, “Ultimately, outside of the villages, you can’t really trade cell phone minutes for anything. So we want to utilise that same mindset to take advantage of that mechanism outside of Africa – so even when they leave the continent, they can be able to utilise all of their credits and really be able to purchase real things.”

The token will be used to pay for a number of fees including transaction fees, advertising fees, and as a means of exchange across the network, among others. Akoin will be launched on top of the Stellar (XLM) network and can be held in both Stellar and Akoin wallets.

The whitepaper identifies a number of industries the Akoin team believes could significantly benefit from: mobile credit trading, micro-lending, phone credit lending, solar energy trading, media sharing and healthcare.

The whitepaper states only 10% of Akoins will be distributed via an initial exchange offering (IEO), which will be conducted in partnership with a “top tier cryptocurrency exchange” during the second quarter of 2020. The IEO will distribute only 45 million Akoins at $0.15 each, giving the offering a hard cap of $6.75 million. IEO participants will need to contribute in the form of XLM.

The remaining 90% of Akoins supply will be distributed among advisors, the team and foundation, the Akoin wallet Retail Exchange, and treasury in varying amounts. The remaining amount will be placed in Akoin’s escrow fund, from which 2% will be released each month for 48 months.

The total supply is expected to be released over four years, however, this could be subject to change depending on unneeded Escrow tokens.

Bitcoin shopping boosted by social distancing

Government-imposed quarantines, social distancing and work from home policies have led to a surge in online shopping – and the trend has spread to the crypto sector.

Major outlets in the US like Walmart and Amazon have reported struggling to keep up demand from “panic buyers”. But there has also been unprecedented growth for a number of crypto payment processors. Lolli, a Bitcoin rewards application, reported a doubling in sales from retailers supplying food and essentials.

“The majority of Lolli’s merchants are online,” the company said. “As a result, our sales have dramatically increased over the last couple of weeks as a reaction to the pandemic. We expect to see this continue over the next several weeks as people transition to a remote work schedule and prepare for COVID-19.”

Strike by Zap, a lightning implementation currently running in beta, nearly shut down after its payments increased beyond expectation and capacity. Jack Mallers, Zap CEO said the wallet “crushed its all-time-highs last week,” after processing over a Bitcoin’s worth of transactions.

Fold, another crypto payments startup with lightning integrations has experienced inventory issues since February. Will Reeves, Fold CEO said “most activity has been focused on prepping” with many users stocking up on first aid and other supplies.

ZenGo, a Tel Aviv-based wallet startup with customers in over 70 countries, has also noticed record volumes of people buying crypto and using it for remittance. Chief Executive, Oriel Ohayon attributes the uptick as part of a growth trend that began in January, and not necessarily due to the coronavirus.

Keep reading…

Top crypto trends to watch out for in 2020

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press