Playing catch-up: A short history of India’s crypto regulation

During the nation’s budget presentation, India’s Finance Minister Nirmala Sitharaman announced a 30% tax on any income from the transfer of virtual digital assets alongside concrete plans to launch the country’s own digital rupee in 2022-23.

“There has been a phenomenal increase in transactions in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime,” Sitharaman said in the Indian budget speech.

Although neither the word ‘crypto’ nor ‘cryptocurrency’ was uttered during the presentation, it is understood that the term refers to crypto assets in general. While clarity of the terms used to describe cryptocurrencies may have been missing, the announcement did provide clearer guidelines and marked the latest move in a long history of legislative efforts by the world’s largest democracy.

Playing catch-up

India’s efforts to try and regulate cryptocurrencies date back as far as 2013, with the launch of Unocoin, one of the first cryptocurrency exchanges in India, coupled with the rise in the price of Bitcoin from $100 to $1,000.

This marked the first instance the Reserve Bank of India (RBI) took notice of cryptocurrencies, issuing a warning to the public stating that their prices were a ‘matter of speculation’ despite them having been around for more than a decade.

As the price of Bitcoin and other popular cryptocurrencies rose, so too did the legislative enthusiasm of the RBI, culminating in an order banning all financial entities from dealing with any cryptocurrency exchanges in 2018.

It didn’t take long for this to change, however, as in March 2020, the Supreme Court overturned the RBI’s ban as interest in cryptocurrencies reached an all-time high following global COVID-19 related lockdowns.

An inconsistent past

Despite the subsequent ruling by the Supreme Court, the Indian government has continued to send out mixed messages on its crypto stance, from stating its intent to take all measures to outright banning its use to promising it will explore the use of blockchain technology to help transform its economy.

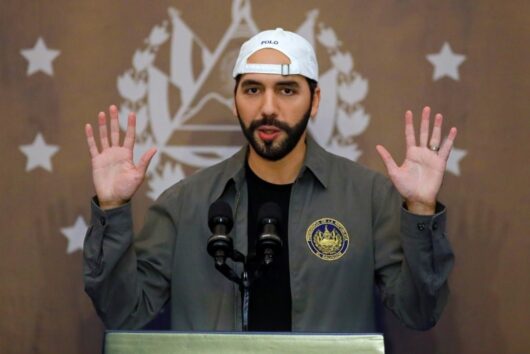

In December of 2021, just a few months prior to today’s budget forecast, Sitharaman reaffirmed that the country’s government has no intention of introducing Bitcoin as legal tender in the country.

According to the country’s leader, India might simply be looking for a helping hand to assist in guiding its regulative decisions regarding cryptocurrencies. In January, Indian Prime Minister Narendra Modi called for global cooperation on crypto, stating that it cannot be tackled by nations in isolation. However, it remains to be seen if anything will come from this call for collaboration.

Paving the way for crypto adoption

Although India’s past has been filled with attempts to approach regulation and incorporate these assets into the nation’s existing economy, the intent of the CBDC launch as part of the budget announcement marks a positive step towards wider recognition by legislative bodies.

Speaking on the adoption of CBDCs, Sitharaman said that a “digital rupee” will be “issued using blockchain and other technologies; to be issued by RBI starting 2022-23. This will give a big boost to the economy.”

Could we see a reversal in the government’s stance to use Bitcoin as legal tender? While it is considered unlikely for the time being, the budget announcement certainly marks a far cry from the Indian government’s stance just last year, and with tax clarities and a CBDC on the horizon, a crypto-positive future for India is more likely than ever before.

Discover

Discover Help Centre

Help Centre Status

Status Company

Company Careers

Careers Press

Press